The Apt Differs From the Capm Because the Apt

The APT differs from the CAPM because the APT. Suppose that the tangent portfolio is wT wAwBwC025050025.

APT assumes a few large changes are required to bring the market back to equilibrium.

. The APT differs from the CAPM because the APTA places more emphasis on market riskB minimizes the importance of diversification C recognizes multiple unsystematic risk factorsD recognizes multiple systematic risk factors. The APT differs from the CAPM because the APT a places more emphasis on market The apt differs from the capm because the apt a School University of New South Wales. CAPM assumes many small changes are required to bring the market back to equilibrium.

CAPM assumes many small changes are required to bring the market back to equilibrium. CAPM only looks at the sensitivity of the asset as related to changes in the market. APT is supply side in that it usually includes macroeconomic factors.

The APT differs from the CAPM. CAPM depends on risk-return dominance. Another difference is that in APT the performance of the asset is taken to be.

Arbitrage pricing theory as opposed to CAPM is a multifactor model. CAPM depends on risk-return dominance. While all sources of risk were clubbed together in CAPM APT says that different securities have different sources of risk because of different exposure to the various factors.

However the difference lies in the use of a single non company factor and a single measure of relationship between price of asset and the factor in the case of CAPM whereas there are many factors and also different measures of relationships between price of asset and different factors in APT. The arbitrage pricing model APT has developed as a response to the CAPM by Ross 1976. CAPM depends on risk-return dominance.

APT assumes a few large changes are required to bring the market back to equilibrium. 8-4 CAPM and APT Chapter 8 CAPM requires that in equilibrium total asset holdings of all investors must equal the total supply of assets. Compared to CAPM Arbitrage pricing theory APT is a broader based theory which states that all of the systematic factors may not be represented in the single market factor represented by the CAPM.

APT depends on a no arbitrage condition. Both the capital asset pricing model CAPM and the arbitrage pricing theory APT are methods used to determine the theoretical rate of return on an asset or portfolio but the difference between APT and CAPM lies in the factors used to determine these theoretical rates of return. APT introduced the concept of factors in asset pricing where factors are quantified macroeconomic shocks.

CAPM assumes many small changes are required to bring the market back to equilibrium. The APT model requires fewer assumptions and considers multiple factors to help explain the risk of an asset. However the difference lies in the use of a single non company factor and a single measure of relationship between price of asset and the factor in the case of CAPM whereas there are many factors and also different measures of relationships between price of asset and different factors in APT.

It permits for an explanatory versus statistical model of. We show this through the example below. An important difference between CAPM and APT is.

APT depends on a no arbitrage condition. Like the CAPM the APT examines the relationship between expected returns and the risk. APT in essence is a mere extension of CAPM.

An important difference between CAPM and APT is A. Finance questions and answers. A major alternative to the capital asset pricing model CAPM is arbitrage pricing theory APT proposed by Ross in 1976.

CAPM is considered demand side in that it is based on the markets aggregation of individual investors utility maximisation curves. Some researchers have even used its altered and more improved forms to try to decrease the problems encountered due to its oversimplifying assumptions. There are only three risky assets A B and C.

APT assumes a few large changes are required to bring the market back to equilibrium. An important difference between CAPM and APT is A. Another difference is that in APT the performance of the asset is.

The Capital Asset Pricing Model CAPM is a special case of the Arbitrage Pricing Model APT in that CAPM uses a single factor beta as sensitivity to market price changes whereas the APT has multiple factors which may not include the CAPM beta. The Capital Asset Pricing Model CAPM is a special case of the Arbitrage Pricing Model APT in that CAPM uses a single factor beta as sensitivity to market price changes whereas the APT has multiple factors which may not include the CAPM beta. APT depends on a no arbitrage condition.

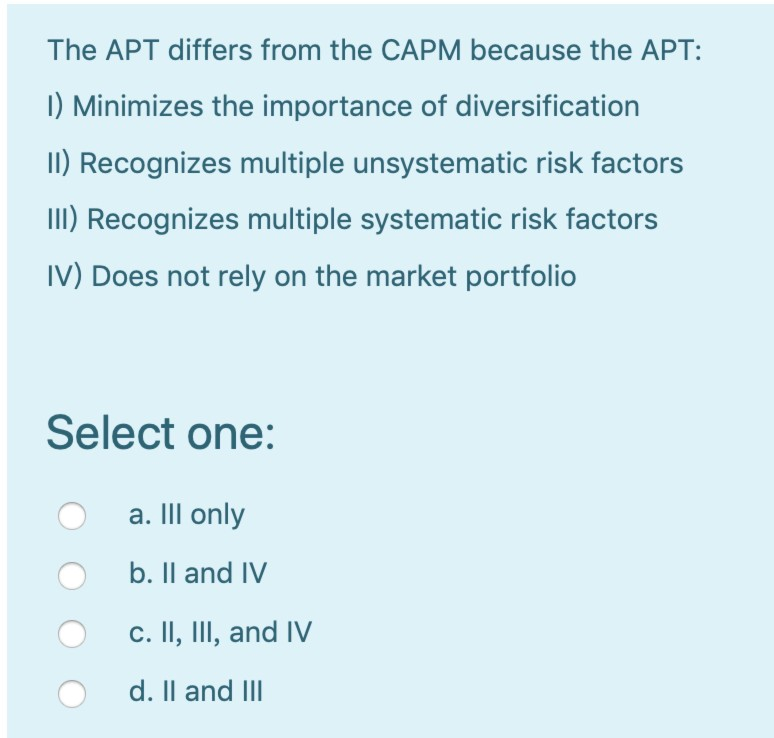

Conversely the APT formula has multiple factors that include non-company. 1 Minimizes the importance of diversification I Recognizes multiple unsystematic risk factors I Recognizes multiple systematic risk factors IV Does not rely on the market portfolio. The APT together with the capital asset pricing mannequin CAPM is considered one of two influential theories on asset pricing.

The APT differs from the CAPM in that it is much less restrictive in its assumptions. However according to the CAPM all investors invest in terms of the expected return and risk of the individual assets. At first glance the CAPM and APT formulas look identical but the CAPM has only one factor and one beta.

The APT differs from the CAPM because the APT A places more emphasis on market The apt differs from the capm because the apt a School University of California Berkeley.

Application Of Capital Asset Pricing Capm And Arbitrage Pricing Theory Apt Models In Athens Exchange Stock Market Stock Market Capital Assets Saving Money

Capital Asset Pricing Model Arbitrage Pricing Theory By I Gede Audi

Solved The Apt Differs From The Capm Because The Apt 1 Chegg Com

No comments for "The Apt Differs From the Capm Because the Apt"

Post a Comment